Advantages of Filing Form 941 Online?

The IRS recommends that you file 941 online for quick processing. You may also reduce the chances of errors and rejection with the help of internal audit checks. Most importantly, you can get the filing

status instantly

Visit https://www.taxbandits.com/payroll-forms/e-file-form-941-online/ to know more about the advantages of Filing Form 941 online.

How to File Form 941 Online?

E-File Form 941 by following a few simple steps and stay tax compliant for the quarter. Below are the steps that you need to follow

-

Enter Form Information

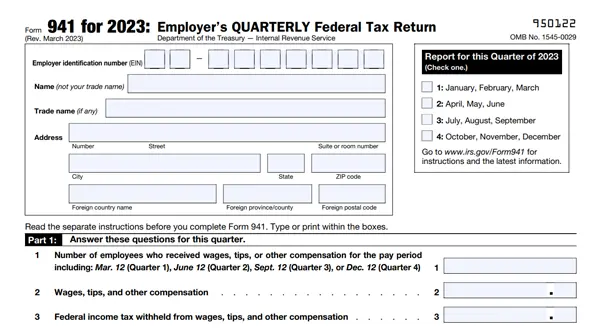

To file Form 941, enter business information, wages paid to employees in the quarter and the respective taxes withheld.

-

Review Information

Review the entered information in 941 Form. If you find any errors in the return, edit the information, and sign the return.

-

Transmit to IRS

Transmit the return directly to the IRS. You’ll be notified of the status when the IRS

approves your return.

You can File Form 941 online in less than 5 minutes and get the filing status instantly.

When is the Deadline to File Form 941?

Form 941 must be filed every quarter on the last day of the month following the reporting quarter. In case the Form 941 deadline falls on a weekend or federal holiday, the return must be filed on the next business day.

| Quarter | Reporting Period | Due Date |

|---|---|---|

| Quarter 1 | Jan, Feb, and Mar | May 01, 2023 |

| Quarter 2 | Apr, May, and Jun | July 31, 2023 |

| Quarter 3 | Jul, Aug, and Sep |

October 31, 2023 |

| Quarter 4 | Oct, Nov, and Dec |

January 31, 2024 |

What are the Penalties for Not Filing Form 941 on time?

The IRS will impose penalties for both not filing form 941 and not paying taxes on time. Below are the penalty rates for late filing of form 941:

If you miss filing form 941 within the deadline:

There will be a penalty of 5% of the total tax due, and an additional 5% of the total tax due for each month the filing is not done until it reaches 25%.

If you miss paying tax due:

There will be a penalty of 0.5% of the total tax due (in addition to filing penalty, if apply). The penalty will increase up to 1% of the tax due, 10 days after the IRS sends an intent to levy notice.

You can File now with us to avoid the 941 penalties.

Ready to File Form 941 Online For 2023?

File Tax Form 941 online easily and quickly with us.It will take only a few minutes to complete the filing process.

Frequently Asked Questions for Filing Form 941 Online?

- What are the advantages of e-filing Form 941?

- What information should be reported in Form 941?

- How long does it take to file a Form 941?

- I don’t have an EIN, how can I file Form 941?

- How Long Does it Take the IRS to Accept or Reject a

Form 941 Return?